January 9, 2025

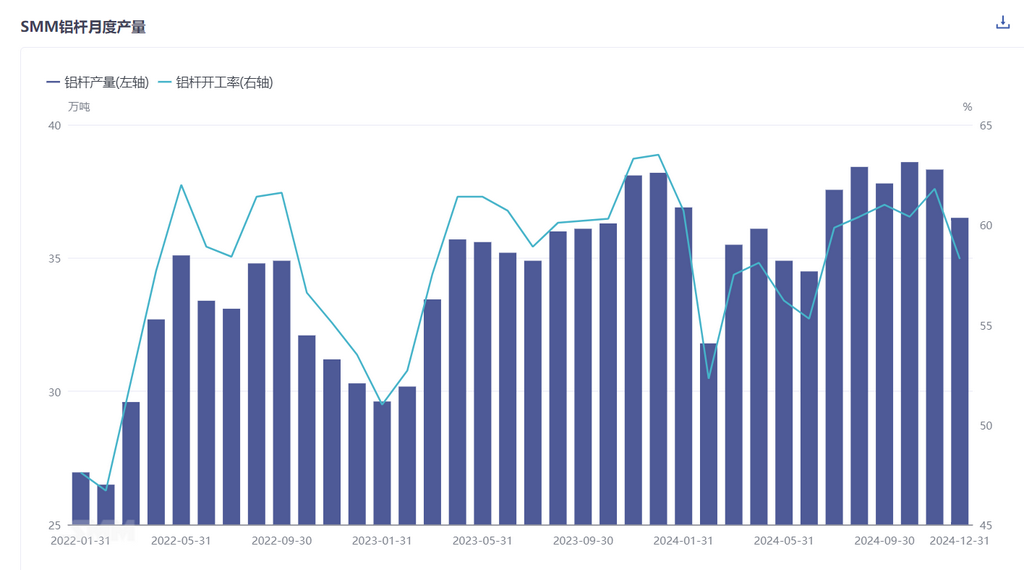

According to the latest monthly survey data from SMM, the total aluminum rod production in China for December 2024 was 365,100 mt, a decrease of 18,100 mt compared to November, down significantly by 4.72% MoM. After adjusting for the impact of the number of days in the month, the operating rate of aluminum rod plants recorded 58.29%, down 2.89% MoM. Entering November, downstream operations transitioned into the off-season, with weak consumption across regional markets. Domestic aluminum rod plants began to face pressure on operating rates, leading to production adjustments. Although both supply and demand weakened, the impact of poor demand was more pronounced, shifting the market structure towards a supply surplus.

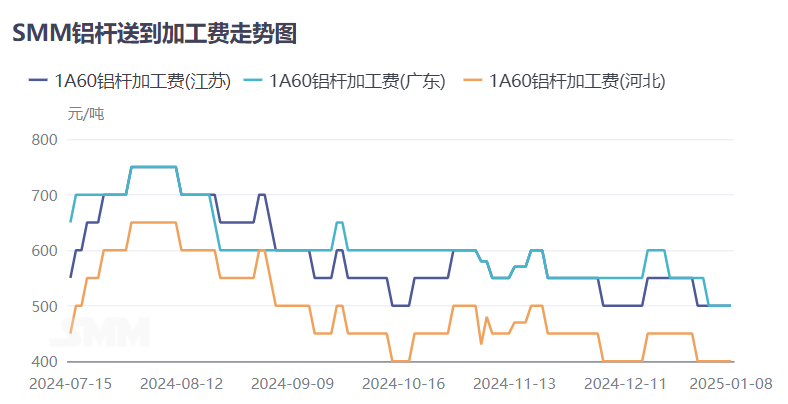

In December, the aluminum rod market in major regions was notably quiet. Downstream aluminum wire and cable enterprises officially entered the off-season, with urgent orders from earlier periods already delivered. Downstream operations weakened rapidly, and aluminum prices declined under pressure. The market mainly operated on a just-in-time purchasing basis, with suppliers actively standing firm on quotes, resulting in relatively subdued transactions. Despite the sentiment to stand firm on quotes, insufficient downstream purchasing limited the market. Aluminum rod supply remained relatively ample, and processing fees faced pressure and pulled back.

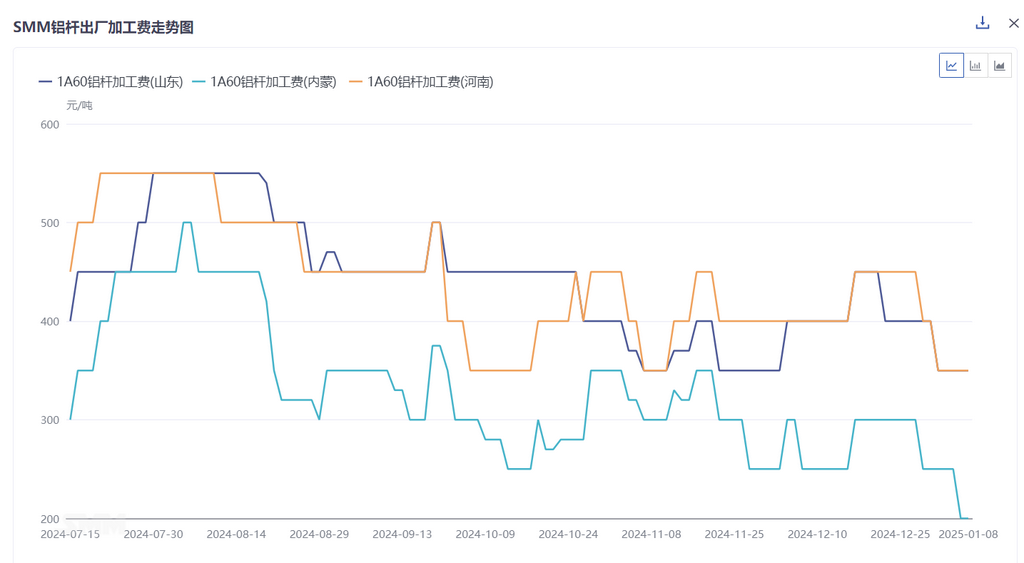

In terms of specific processing fees, the December ex-factory monthly average price for 1A60 in Shandong was 404 yuan/mt, up 34 yuan/mt MoM; in Henan, the ex-factory monthly average price was 420 yuan/mt, up 18 yuan/mt MoM; in Inner Mongolia, the ex-factory monthly average price was 275 yuan/mt, down 16 yuan/mt MoM. Among the three major trading regions, the delivered monthly average price in Hebei was 427 yuan/mt, down 23 yuan/mt MoM; in Jiangsu, the delivered monthly average price was 527 yuan/mt, down 23 yuan/mt MoM; and in Guangdong, the delivered monthly average price was 559 yuan/mt, remaining stable.

Market-wise, aluminum rod supply in December remained stable with a slight decline, while downstream demand transitioned into the off-season. Regional aluminum rod availability was relatively loose, with inventories at manufacturers gradually accumulating, highlighting the supply-demand imbalance. Processing fees were mainly under pressure. In specific market segments, demand for ordinary rods essentially entered the off-season, primarily due to slower deliveries from the State Grid and weak downstream purchasing demand. For aluminum alloy rods, the slower pace of new energy grid connections led to average consumption. Meanwhile, for enamelled wire aluminum rods, consumption was notable due to policy support for home appliances and a "rush to export" trend in South China.

Based on SMM's year-round tracking of aluminum rod plants, the total sample production of aluminum rods in 2024 was 4.354 million mt, compared to 4.19 million mt in 2023, an increase of 160,000 mt, up 3.92% YoY. With the country's strong promotion of green energy, the number of new energy grid connections has been increasing daily, ushering in a boom for aluminum wire and cable, which has driven growth in aluminum rod consumption. Although aluminum wire and cable performed exceptionally well this year, the performance of different aluminum rod segments varied, with processing fees being overall satisfactory. The main reasons include, on one hand, aluminum rod plants bearing the role of consuming liquid aluminum. Despite seasonal fluctuations, operating capacity fluctuated at highs. On the other hand, aluminum rod products are segmented into specific markets. For instance, the high-conductivity aluminum rod market faced relatively small competition, with processing fees remaining high, while the 1-series ordinary rod market had ample supply and fierce competition, creating resistance to price increases. Currently, upstream manufacturers are inclined to build finished product inventories to get through the Chinese New Year holiday. It is expected that inventory pressure within plants will continue to increase before and after the holiday, with ample market supply, leading to a pessimistic outlook for aluminum rod processing fees.